2023 will proceed to convey financial uncertainty because the Federal Reserve continues to extend brief time period charges to decrease inflation. Although the next rate of interest atmosphere can create a tough working atmosphere for actual property typically, REITs have positioned their stability sheets to be resilient in 2023. Because the finish of the International Monetary Disaster (GFC), REITs have lowered their publicity to larger rates of interest by decreasing leverage and curiosity expense, utilizing mounted charge debt, and growing the time period of the debt they maintain.

REITs Have Traditionally Low Leverage

Contents

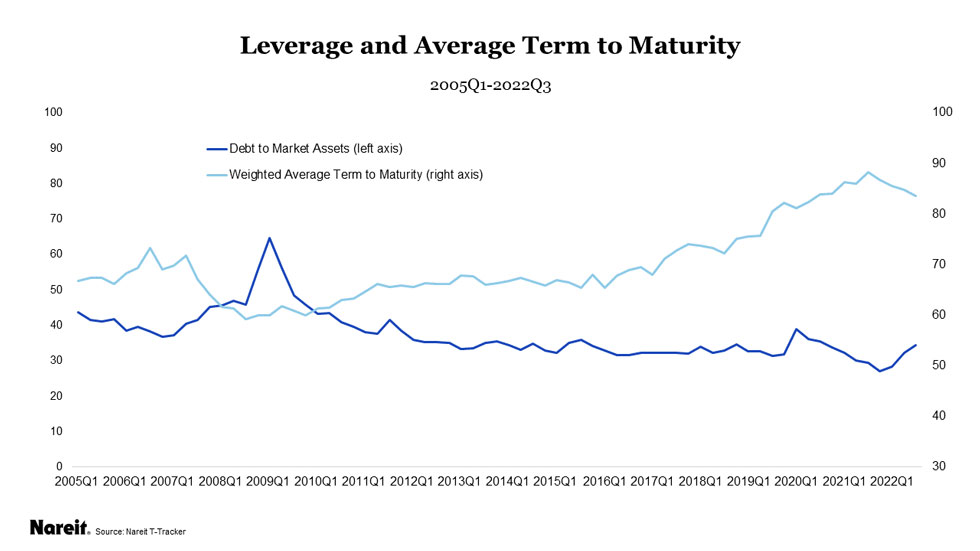

Leverage, as measured as debt-to-market belongings, has stayed under 40% since 2011, and has stabilized within the low to mid 30% vary since 2016. For instance, as of the third quarter of 2022, leverage is at 34.5% with a weighted common time period to maturity of 83.5 months, or greater than seven years.

The chart above tracks these two measures since 2005. Leverage was growing by means of the run as much as the GFC and briefly spiked in 2009 at 64.7% when market values fell.

REITs Have Properly-Termed, Properly-Structured Debt

REITs have an extended runway to handle leverage within the larger rate of interest atmosphere as a result of they’ve used mounted charge debt to lock in low rates of interest for lengthy phrases.

For instance, throughout the identical timeframe illustrated within the above chart, the weighted common time period to maturity elevated considerably. The time period of debt was simply greater than 59 months (virtually 5 years) in 2005 and rose to its peak in 2021 of 89 months (virtually seven and a half years). The time period of debt has shortened barely in 2022, as new debt issuance has been effectively under historic ranges, however stays close to all-time highs.

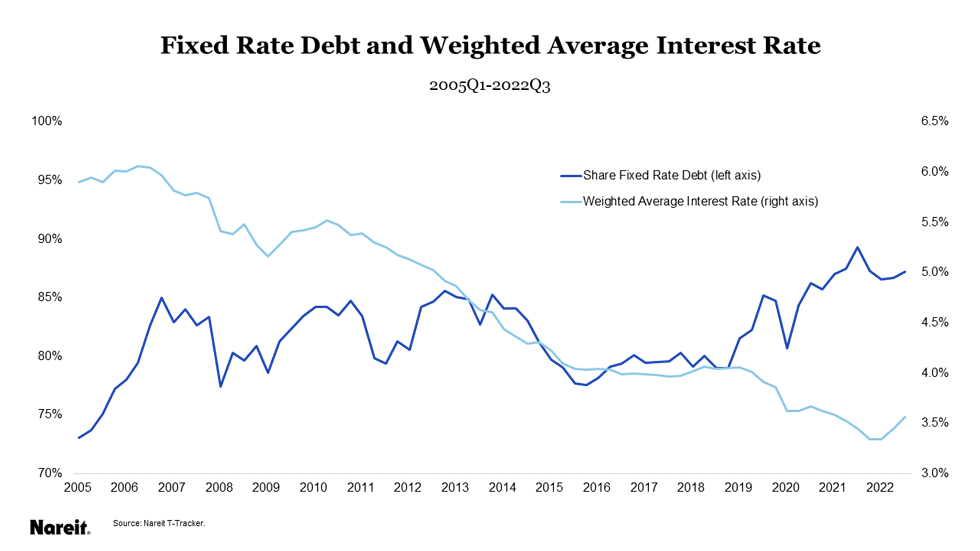

The chart above reveals the mounted charge share of whole debt since 2005 and the weighted common rate of interest on the full debt excellent. The share of mounted charge debt has elevated from 73% in 2005 to greater than 85% in 2021 and 2022. Similtaneously REITs have moved to mounted charge debt, the common rate of interest on their debt has fallen. REITs have been capable of lower their weighted common rates of interest from 5.9% in 2005 down to three.6% within the third quarter of 2022.

With much less publicity to variable charge debt, and as beforehand proven, lengthy common phrases to maturity, REITs locked in debt at low charges limiting their publicity to larger charges in 2023.

One results of reducing leverage over the previous a number of years for the trade has been decrease curiosity bills as a share of NOI. Curiosity expense as a share of NOI had been at 37% in 2009. Since that point, it has skilled a precipitous drop as REITs have diminished leverage and financed their debt with low rate of interest debt. As of the third quarter of 2022, it was at 18.9%. As famous above, REITs even have most of their debt at mounted charges, with 87.2% of whole debt at mounted charges.

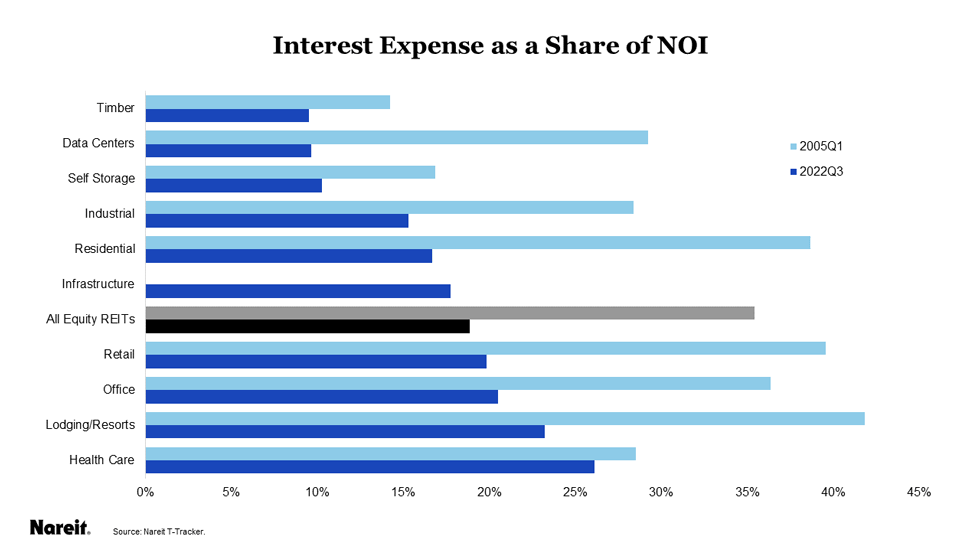

The chart above tracks curiosity expense as a share of NOI for the ten pure-play property sectors evaluating the start of 2005 to the third quarter of 2022 (infrastructure was not separated into its personal property sector till 2012). All sectors have diminished curiosity expense as a share of NOI from 2005 ranges. Notably, even the sectors with the best ratios of curiosity expense to NOI as we speak have ranges under the trade common for 2005 of 35.4%.

Residential has skilled the most important discount in curiosity expense to NOI since 2005, down 22 foundation factors, adopted by information facilities and retail, each down 20 foundation factors. Timber and information facilities are each far under the trade common for curiosity expense, under 10%, and have tended to maintain curiosity expense decrease than the trade common. Lodging/resorts and well being care are above common at 23.2% and 26.1% respectively. Well being care has had the smallest discount in curiosity expense share, down solely 2 foundation factors.

In 2023, the next rate of interest atmosphere will translate to larger charges on each variable debt and new debt, leading to larger curiosity bills and a bigger debt providers burden. REITs are in a robust place to climate larger charges and compete towards extra extremely levered market contributors for property purchases as a result of they successfully managed their stability sheets.

Obtain a PDF of the 2023 REIT Outlook

Supply By https://www.reit.com/information/weblog/market-commentary/2023-reits-are-likely-remain-resilient-higher-interest-rates